| |

AIQ Data Power Packs

|

|

FATI Sector Lists & Fundamental Data plus monthly IPOs |

The Ultimate Data Analysis Package is here. Find the stocks the professionals are watching and avoid those illiquid stocks with wide bid/ask spreads. Quality and Opportunity is right here. Stocks fitting the criteria are arranged into the FATIŪ Sector and Group Structure.

These lists contain stocks which have the following four key characteristics.

Average Daily Trading Volume > 84,999 shares

PRICE >=$1.00 & 20 DAY AVG VOLUME >=10,000 shares

Number of Analysts Ratings >= 2

Market Valuation > $99 million

Click here for a PDF overview of FATI and why it makes sense for your trading or investing.

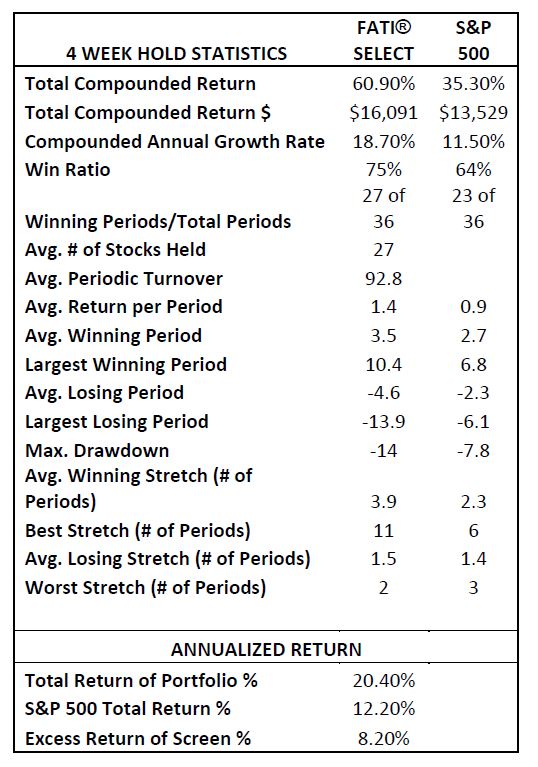

Historical backtesting was performed over 36 four week holding periods. June 21st, 2013 through April 1st, 2016.

* See Performance Disclosure Below

|

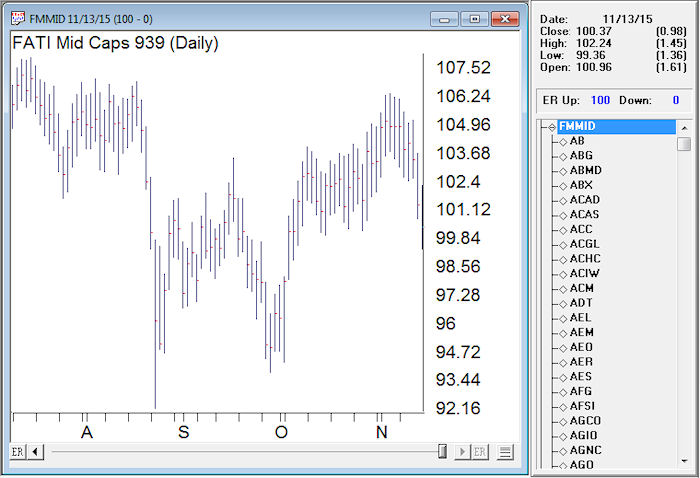

FATIŪ Market Capitalization - Same list of stocks as in the FATIŪ Sector & Group list broken down by market capitalization.

|

Mega Cap > $50bn

Large Cap > $10bn < $50bn

Mid Cap > $2bn < $10bn

Small > $1bn < $2bn

Micro > $500mn < $1bn

Nano >$99mn < $500mn |

-

FATIMKTS List - The "Market Breadth" files for the six (6) FATI Market Capitalization Sectors (MegaCap to NanoCap) & the (1) FATIŪ Sector and group Index. This provides breadth indicators for these segements

- FATISLCT List - Monthly FATI Select List of Fundamentals Screened stocks. This is a ready to use list of fundamentally screened stocks

- Monthly IPO lists

You hear about them in the news all the time. The latest pioneering company going 'public' and ringing the bell at the open of the NYSE. You hear about them in the news all the time. The latest pioneering company going 'public' and ringing the bell at the open of the NYSE.

There are new companies being listed every month on the US markets, stocks and ETFs you might want a slice of the action.

Now AIQ is offering a unique monthly service providing you with the AIQ list file and ticker file for these IPOs. Add them to your existing database with a simple download and quick install each month.

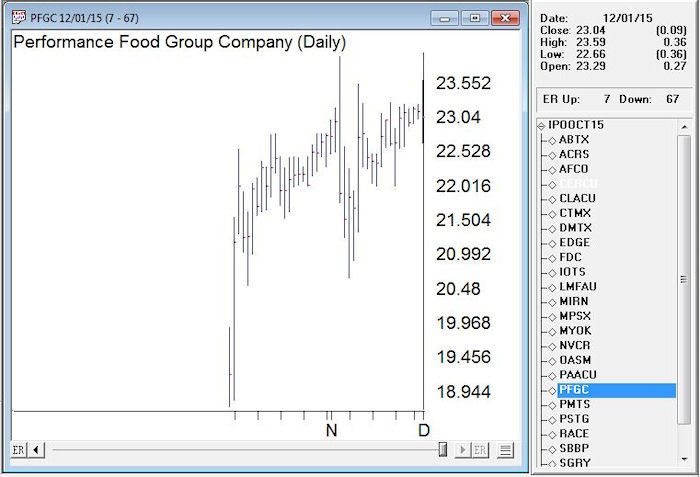

PFGC Performance Food Group Company IPO in October 2015

Keep your database up to date with the latest listing of stock and ETF IPO's from the previous month.

FATIŪ mid cap tickers

Fundamental Data - 60 fundamental data fields covering 4400 stocks.

|

Options

Shares Outstanding (mil)

Sales ($mil)

% Held by Institutions

% Held by Insiders Net

% Chg Holdings 12 Wks Market Cap ($mil)

Current Ratio

Avg Daily Vol 20 days

Beta

Avg Broker Rating

No. in Rating

% Change Completed Qtr Est - 4 wks

% Change Curr Qtr Est - 4 wks

% Change Next Qtr Est - 4 wks

% Change Curr Fiscal Yr Est - 4 wks

% Change Next Fiscal Yr Est - 4 wks

Est EPS Growth Current Year

Est EPS Growth Curr & Next Yr

Qtr EPS this Qtr/ prior qtr

Qtr EPS last Qtr/ prior qtr

Qtr EPS 2Qtrs ago/ prior qtr

Anl Sales this Yr/ Sales last Yr

2 Years Ahead Sales Growth

Cash Flow 5 Yr Avg

Div Yield

Indicated Anl Div

Payout Ratio

P/E using Curr FY Est

P/E using Next FY Est

Return on Equity

Return on Assets

Return on Investment

Inventory Turnover

Receivables Turnover

Asset Utilization

Debt/ Tot Cap

Debt/Equity Current Ratio

Market Capitalization

Quick Ratio

Cash Ratio

Interest Coverage

Cash Flow ($/sh)

Price/ Book

EV/EBITDA 12 Mo

P/E F1/ LT EPS Gr

Pretax Mgn 12 Mo

Net Mgn 12 Mo

Oper Mgn 12 Mo

Current Fiscal Yr Cons Est

# Anlst in Cons Current Fiscal Yr

Next Fiscal Yr Cons Est

# Anlst in Cons Next Fiscal Yr

Completed Quarter Cons Est

# Anlst in Cons Completed Qtr

Current Quarter Cons Est

# Anlst in Cons Current Qtr

Next Quarter Cons Est

# Anlst in Cons Next Qtr

12 Mo EPS before NRI

Piotroski Score

|

Ford display of fundamentals in AIQ Charts

Updated tickers, list and fundamental data every month

Your price will be only $29.99/mo.

SAVE $$$$$$$

Order all 3 Power Packs for one low price

$78.96.mo.

$59.97/mo.

Performance Disclosure

Performance Disclosure

The performance calculations for the FATI Ultra Fundamentals were produced through backtesting

and consist of the total return (price changes + dividends) of an equal weighted portfolio.

Returns are calculated on a specified periodic basis (most often one, four or twelve weeks and

assume no transaction costs. The portfolio is rebalanced at the start of each new period. Returns

are stated as either annualized or compounded returns.

Stock trading/investing involves risk and you can lose some or all of your investment. Hypothetical

or back]tested results may not always be duplicated in the real world. Back]testing can at times

produce an unintended look]ahead bias. Results can also at times be over or understated due to

the exclusion of inactive companies. In addition, hypothetical trading does not involve financial

risk, and no hypothetical trading record can completely account for the impact of financial risk in

actual trading, not the least of which is the ability to withstand losses or to adhere to a particular

trading strategy in spite of trading losses. These are material points which can also adversely affect

actual trading results. The back]tested results prepared for the FATI Ultra Fundamentals consisted

of only active companies.

Potential Limitations in Backtesting

There are four types of biases which may distort back]test results.

1. Look Ahead bias ] this occurs when the stocks selected on a rank date use financial information

that was not available on that rank date. For example: if a company reports its financials for the

quarter ending Mar 2006 on Apr 20, 2006, the rank that is created at the end of the March 2006

quarter should not use the financials for that quarter, since they were not available at the end of

the quarter.

2. Restatement bias ] this occurs when a company restates its historical financials. For example: if

a company reports its 3/16 results and restates its Dec 2015 results; a rank done as of end of Dec

2015 should use the originally reported financials for Dec 2015, not the restated financials for Dec

2015 which were not available until March 2016.

3. Survivor bias ] this occurs when stocks that have been delisted or acquired are not included in

the back]test results. Depending on your strategy, the impact of survivor bias on the back]test

may or may not be significant.

4. Split bias ] this can occur if your screen uses price as a qualifier, e.g., Price > $5.00. The database

is split adjusted. So, using the example above, if the company had a stock split between the

screened date and the date of the back]test, the company may not be included in the back]test

results if the split adjustment caused the historical price at the date of the back]test to be below

that $5.00 threshold. Typically, stock splits occur at higher prices.

|

|

You hear about them in the news all the time. The latest pioneering company going 'public' and ringing the bell at the open of the NYSE.

You hear about them in the news all the time. The latest pioneering company going 'public' and ringing the bell at the open of the NYSE.